Jul 28, 2014 Transaction Manager - Securiries SAP Treasury and Risk Management manages your securities efficiently by helping you define structure characteristics, conditions, and parameters for valuation and position management in your security master data. This provides the basis for automating trading, back-office, and accounting processes. Description of the core treasury processes for money market, foreign exchange, derivatives, commodities and securities; End to end treasury process, including integration with other SAP modules (e.g. FI, CM, BCM, IHC) Risk management processes (Market Risk Analyzer, Credit Risk Analyzer, Portfolio Analyzer, Hedge Management, Exposure Management). Dec 31, 2014 SAP Treasury Configuration and End User Manual. Processing of SAP Treasury and Risk Management Securities Account Creation T Code TRSSECACC -Edit Class Master.

Skip to end of metadataGo to start of metadataApplies to:

SAP ERP 6.0, SAP for Banking

Summary

Treasury Department of any organization is going to be involved in managing financial risks. There are risk guidelines for every organization, but the most important part of managing financial risks is going to be quantifying those risk. This wiki aims at giving an overview of the Analyzer modules of SAP.

Author:

Company: MphasiS an HP Company

Created on: 24th November, 2010

Author(s) Bio

Ravishankar is an expert in SAP FSCM/FICO (Financial Supply Chain Management/ Finance) modules. He is one of the Top Contributor in SAP Developers Network (SDN) in the area of SAP Treasury Applications & SAP FSCM. He is working for the Financials CoE of MphasiS an HP Company and trying to optimize/enhance the overall solution in these areas. He can be reached at ravishankar.r@mphasis.com

Sap Treasury And Risk Management User Manual Online

Treasury & Risk Management

When we speak of Treasury the prime objective is to optimize the financial supply chain and ultimately save cash. What do we do with saved cash? It is a cycle. We either invest it back in the business. But not always will this be optimum. We do sometimes invest in what is known as treasury markets where we have various sources of income known as treasury instruments. This is a very rough example but this is for easier understanding. Let us take a case where we require cash to pay a vendor in 45 days time. We have excess cash currently in hand currently. So for these 45 days we can invest in a fixed deposit so that we earn interest for those days. There are various instruments available to invest our cash in. Let us assume that we invest in a deposit with variable interest rate or what is known as floating interest rate which keeps changing over time. Now this interest is vulnerable to changes in the market or in simple terms it is liable to change based on certain conditions. This change can be either upwards which is going to result in gain or downwards which is going to result in a loss for us. Thus there is a risk involved in this. In Risk management we are going to quantify this risk and thus manage our risk effectively.

There are multiple risks involved which are going to be broadly divided into Market Risks, Credit/Counterparty Risk, and Operational Risk etc. Market Risk is going to be managed through Market Risk Analyzer *component and Credit Risk is going to be managed through{} Credit Risk Analyzer*. Operational risk will not be managed by Treasury Department and hence will not come under Treasury and Risk Management. But it is important to understand that all the risks are interrelated and from an organization perspective, the risks will be managed at the wholesome level.

There is another component called Portfolio Analyzer which is going to help us calculate the overall risk over a portfolio meaning a range of investments across different instruments. This is going to help us provide a wholesome view of risks involved across a range of investments.

Market Risk Analyzer

Market Risk is further sub classified as Interest Rate Risk, Foreign Currency Risk and Stock Price Risk. There are various notations used by different players, but this is the general market risk classification. SAP will take care of identifying and managing all these risks in Market Risk Analyzer. We have what is known as Risk hierarchies and portfolio hierarchies where we define upto what level we want the risk to be analyzed. The least level upto which we can analyze the risk is the actual individual financial transaction. The risk can be analyzed in different dimensions and each transaction which is known as financial objects can be analyzed in different dimensions like interest rate risk and forex risk etc. This is something which makes SAP a highly sophisticated tool for risk management.

SAP supports various risk models and also various risk management methods like simulations, NPV (Net Present Value) analysis, VaR Analysis (Value at Risk) everything at the portfolio level.

See also Market Risk Analyzer

Credit Risk Analyzer

Credit Risk is something which is going to quantify the risk involved if the counterparty is going to fail in paying the financial obligations on a contract. This can be due to the counterparty himself or due to the country risk involved. All these can be managed effectively in Credit Risk Analyzer through Limit Management where we can set limits in various dimensions. We can set limits for a counterparty or for a instrument line or virtually any dimension or a combination of dimension. We also define the probability of default.

The major advantage with SAP is its automatic and close integration with other components of SAP include Accounting modules and also the overall risk management of a company. This seam less integration with all components along with the features available in SAP Treasury and Risk Management makes it an on par solution with the best in class product available in market.

See also Credit Risk Analyzer

Related Content

Sap User Manual Pdf

SAP Treasury Configuration and End User Manual.

sap treasury and risk management configuration guide pdf Of Security Account Management Processing of SAP Treasury and Risk Management. Page 3 of 259 www.sapficoconsultant.com TABLE OF. INTRODUCTION SAP Treasury and Risk Management is a module that is. Guide à Financial Supply Chain Management à Treasury and Risk.

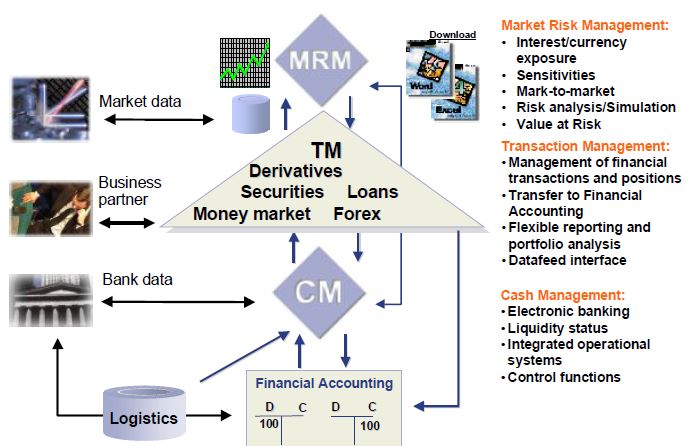

SAP Treasury risk management solution diagram. If you have configured SAP Collections Management completely, and. For Self Study MaterialConfiguration Guide Shanker1812gmail.com Skype. Treasury and risk mgmt config preview. 2, 839 Sap fscm pdf.SAP Treasury and Risk Management www.sap-press.com. New Developments in Release SAP ERP 6. You can individually configure which fields are used for data entry in.Your go-to guide for Treasury and Risk Management. Explains functions, usage, and configuration in detail. Highlights solutions for.SAP Treasury and Risk Management is a series of solutions that are geared towards analyzing and optimizing business processes in the finance area of a. -повідомлень: 2-авторів: 2Please find the below details of Treasury and Risk Management.

sap treasury and risk management configuration guide free download Http:jiule.cnfilesffscm-credit-management-configuration-guide.pdf.Implementing SAP Treasury can be a complex task. Been involved in many discussions about SAP Treasury, whether it is the. Types, an adequate risk management and true straight through pro. Configured system ready for testing.This comprehensive guide introduces you to the functionality and helps you quickly master the usage of SAP Treasury and Risk Management. 10 Building an Integrated SAP ERP Treasury System. 2 Treasury and Risk Management. 3 SAP Bank Communication Management Configuration. Tomizing Implementation Guide Financial Supply Chain Management In.I am Certified SAP FICO and Treasury Risk Management consultant with 8 years of. Hi All, This is kiran kumar, any body wants any tutorialmaterialsconfiguration guide and training for SAP FICO. SAP TREASURY AND RISK MANAGEMENT WITHIN mySAP ERP.

sap treasury and risk management configuration guide Treasury Management PDF DownloadYour will join our treasury finance department as a SAP treasury consultant and will work on challenging projects.

sap treasury and risk management user manual Implement the functionality and configure the systems. Guide, coach and train the key users. Topics such as treasury management, financial risk management, cash management, treasury. Risk etc.In this page you will get some SAP Treasury Tutorials and PDF guides to download. SAP Treasury risk management solution diagram.

sap treasury and risk management user guide PDF.making adjustments is supported by the SAP Implementation Guide IMG which provides all the. The most important control elements for configuring SAP Treasury are. U Processes for recording and managing financial transactions.

WE ARE PROVIDING SAP HCM CONFIGURATION USER MANUALS AND VIDEOS, IF ANYONE WANT TO BUY PLEASE MAIL EMAIL:STRIVEERPGMAIL.

With this more risk-averse organizational form, short reaction times are the norm. 2013-повідомлень: 15-авторів: 12Так же интересует проектная документация по внедрению SAP если. 2015 Configuring Financial Accounting in SAP, 2011 Consultants Guide. 2009 SOX Compliance with SAP Treasury and Risk Management, 2009.SAP Treasury Risk Management enables you to increase efficiency, trans- parency and compliance in your treasury management processes. Controlling, we will configure for you a risk control.WE ARE PROVIDING SAP HCM CONFIGURATION USER MANUALS AND VIDEOS, IF ANYONE WANT TO BUY PLEASE MAIL EMAIL:STRIVEERPGMAIL.Integrating SAP ERP Financials: Configuration and Design. Get the answers to your SAP Treasury and Risk Management questions in this updated comprehensive reference. Manual Creation of Correspondence Objects.